The Honolulu Board of Realtors released their latest monthly Oahu residential real estate statistical reports for December 2022. You can view the reports via the links below:

Oahu General Housing Statistics

Oahu Neighborhood Statistics

November 2022 Oahu Real Estate Statistics by the Honolulu Board of Realtors

The Honolulu Board of Realtors released their latest monthly Oahu residential real estate statistical reports for November 2022. You can view the reports here:

Oahu General Housing Statistics

Oahu Neighborhood Statistics

October 2022 Oahu Real Estate Statistics by the Honolulu Board of Realtors

The Honolulu Board of Realtors released their latest monthly Oahu residential real estate statistical reports for October 2022.

You can view the reports here:

Oahu General Housing Statistics

Oahu Neighborhood Statistics

September 2022 Oahu Real Estate Statistics by the Honolulu Board of Realtors

The Honolulu Board of Realtors released their latest monthly Oahu residential real estate statistical reports for September 2022. You can view the reports here:

Oahu General Housing Statistics

Oahu Neighborhood Statistics

August 2022 Oahu Real Estate Statistics by the Honolulu Board of Realtors

The Honolulu Board of Realtors released their latest monthly Oahu residential real estate statistical reports for August 2022. You can view the reports by clicking on the links below:

Oahu General Housing Statistics

Oahu Neighborhood Statistics

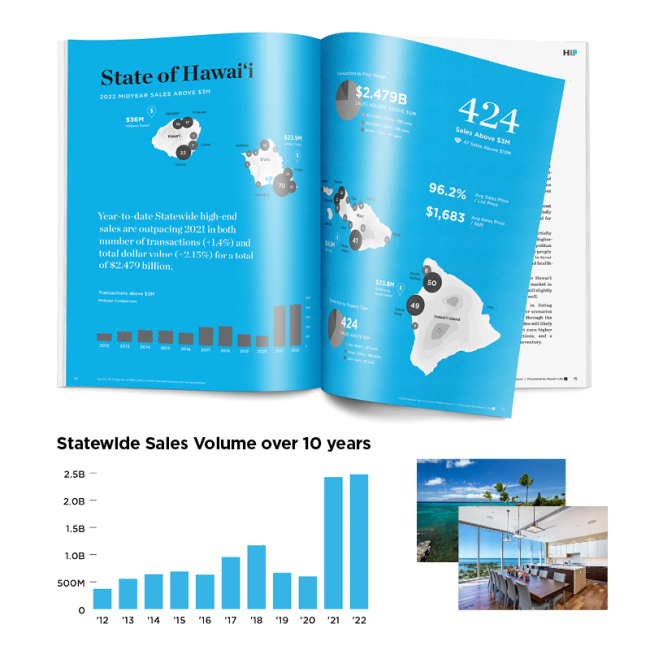

2022 Midyear Hawaii Luxury Market Report

The Choi Group’s successful alliance with Hawaii Life continues to strengthen our service to our clients. We are pleased that the outstanding sales efforts of our talented agents have contributed to making our company the Statewide Leader in Residential Real Estate Sales.

Hawaii Life has dominated the luxury and ultra-luxury market segments for nearly a decade, and continues to be the Luxury Market Leader in Statewide Sales above $3 Million and $10 Million for the first two quarters of 2022.

Following is a link to our 2022 Midyear Hawaii Luxury Market Report featuring sales and trends in Hawaii’s high-end real estate market:

https://report.hawaiilife.com/2022-luxury-market-report-hl-q2/

July 2022 Oahu Real Estate Statistics by the Honolulu Board of Realtors

The Honolulu Board of Realtors released their latest monthly Oahu residential real estate statistical reports for July 2022. You can view the reports here:

Oahu General Housing Statistics

Oahu Neighborhood Statistics

June 2022 Oahu Real Estate Statistics by the Honolulu Board of Realtors

The Honolulu Board of Realtors released their latest monthly Oahu residential real estate statistical reports for June 2022. You can view the reports here:

Oahu General Housing Statistics

Oahu Neighborhood Statistics

May 2022 Oahu Real Estate Statistics by the Honolulu Board of Realtors

The Honolulu Board of Realtors released their latest monthly Oahu residential real estate statistical reports for May 2022. You can view the reports here:

Oahu General Housing Statistics

Oahu Neighborhood Statistics

April 2022 Oahu Real Estate Statistics by the Honolulu Board of Realtors

The Honolulu Board of Realtors released their latest monthly Oahu residential real estate statistical reports for April 2022. You can view the reports here:

Oahu General Housing Statistics

Oahu Neighborhood Statistics